Financial Educator Yanely Espinal Shows Educators the Path to Millionaire Status

When financial educator Yanely Espinal started her third-and-fourth-grade teaching career in Brooklyn, she didn’t have the resources or awareness to be financially literate. Her experience echoes that of many professionals, particularly educators.

Rutgers Alternate Route had the pleasure of featuring Espinal as a guest speaker at the 2021-2022 kickoff meeting for our Diverse Teachers for Diverse Schools initiative. During the virtual meeting, Espinal shared general tips on financial planning and goal setting and encouraged attendees to consult recommended financial planning resources to advance their financial literacy.

When Espinal was in college at Brown University, she received a full-ride scholarship, but was not prepared for the power of consumerism and social pressures which made her particularly vulnerable once she was approved for a credit credit as an undergraduate with no job. When she graduated, Espinal had $20,000 in debt, much of it from credit cards she overused.

“I started by using them to buy things I needed,” she said in the talk. “And slowly, I saw how easy it was to use them and I started buying things I didn’t need.”

Espinal knew she needed to solve her debt, so she began educating herself through books and other resources. Within 18 months, she was able to pay off her debt. Now, she wants to help others prevent the mistakes she made early on and share the resources that have improved her financial literacy.

Currently, Espinal is the director of educational outreach at Next Gen Personal Finance and is also known as “@MissBeHelpful” on Instagram and YouTube, where she offers financial advice to her combined 78,000+ followers and subscribers.

“We're so uncomfortable talking about money, so I just wanted to stop and break those chains and go on YouTube and talk about nothing but money,” she said.

If Espinal had an opportunity to be a first-year teacher again, here are the ways she’d do things differently.

Set monthly goals

A national study of millionaires found that teachers are third on the list. In fact, there were more teachers on the list than there were lawyers and doctors.

“As teachers, we don’t think we have the ability to be part of this group,” Espinal said. “Instead of how much you make, it’s about how much you keep and invest.”

The first step toward financial wellness is to create an emergency fund with at least three months’ worth of expenses.

“Average Americans don’t have enough money saved for an emergency, so before we think about investing and building wealth, we have our savings covered.”

Some experts even recommend up to nine months of expenses, and Espinal says this savings account should be held in a high-yield account, which average 0.55 percent interest.

“We’re talking about chump change here, but it’s better than zero.”

Attack your debt before you start investing

Debt comes first.

“You can’t just invest your money and ignore your debt,” Espinal said. “Because in that case, you’re trying to make a return on investment, but your debt is growing. So, you owe money while you are trying to grow money.”

Either have a plan in place for both or focus on one before the other. In this case, the order would be debt, then invest. The reason is because interest accrued on debts is significant and can cost people tens of thousands of dollars over time.

Espinal says the best way to attack debt is to start by creating a spreadsheet that lists all debts in order by interest rate. Pick off each one in order of highest to lowest interest rate.

“The interest rate matters more than balance.”

For educators that have taught or plan to teach for 10 years, student loan forgiveness is much easier to obtain with the new guidelines.

“These new guidelines cast a much wider net,” Espinal said. “Previously, less than 15 percent of borrowers who applied for student loan forgiveness were accepted to the program.”

Finally, Espinal says it is necessary to lower your expenses. By cutting her non-necessary expenses, she was able to pay off $20,000 in less than two years.

“I just had to get real with myself. I was eating out at restaurants too much,” she said. “Once I started making meals at home, I was able to save hundreds of dollars every month.”

Know how to use your workplace retirement plan

Espinal points out that educators have long careers and have an opportunity to invest pre-tax through their 403(b) plans. Teachers that take advantage of this are able to build significant wealth over time.

“The number one mistake teachers make is not taking advantage of their retirement plans,” Espinal said. “You miss out on stock market returns every year you do not sign up, so you want to make sure you sign up as soon as you can.”

Educators can determine how much they want taken out of their paychecks based on their investment goals. They also receive the benefit of investing that money before their paycheck is taxed.

“That is a beautiful benefit because you get to dodge the taxes now and invest the money in the stock market and then take out the money and pay the taxes,” Espinal said.

When investing, the simplest way for beginners to grow their wealth is to look at mutual funds, which choose the stock investments for you. Espinal recommends going with an index fund like the Dow Jones, S&P 500 and NASDAQ. These are a list of multiple companies, which can help diversify your portfolio.

“No one company is ever worth all of your money.”

On average, investors that put money in the S&P 500 - or, the 500 leading companies in America - never lose more than 43 percent of their money over time. For investors that are seeing losses, Espinal says not to panic.

“It’s a self-cleaning process. Companies that aren’t going to grow and innovate are going to go away. New companies are going to IPO every single year. When those bad times come, you want to add more money to your investments. All the stocks you usually invest in are now on sale.”

Reaching millionaire status

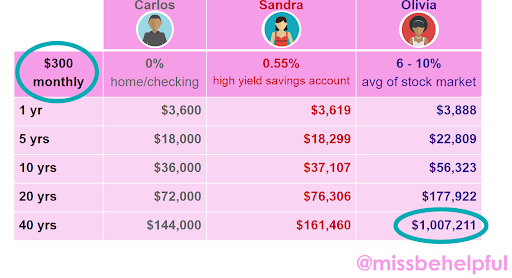

If educators want to reach millionaire status, Espinal says that can happen at the rate of $300 a month over the course of 40 years. But they have to take risks and they have to be patient.

“You have to be in the market 10-20 years to see actual results of your investments,” she said. “The problem is people only want to see positive returns, and that’s not always going to happen. No risk, no reward.”

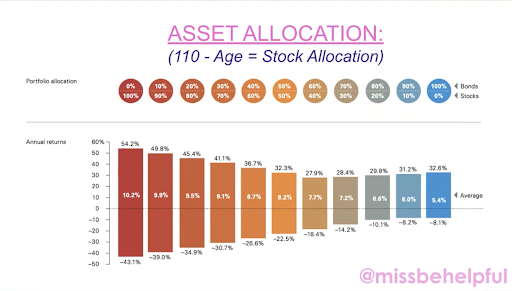

For educators in their 20s and 30s, this is the time to take risks, as they still have many years until retirement. As educators get closer to retirement age, however, they should begin pulling money out of the stock market to invest in bonds.

“Bonds grow slowly, but they are steady,” Espinal said.

A simple way to determine how much to put into the stock market is to take the number 110 and subtract your age. The result is the percentage you should be investing in stocks. The remaining percent should go into bonds.

Seek out resources through books, videos and webinars

Espinal is where she is today because of her discipline. The $20,000 credit-card debt she built up was taken care of in 18 months because of Espinal’s self education and determination to stick to a tight budget.

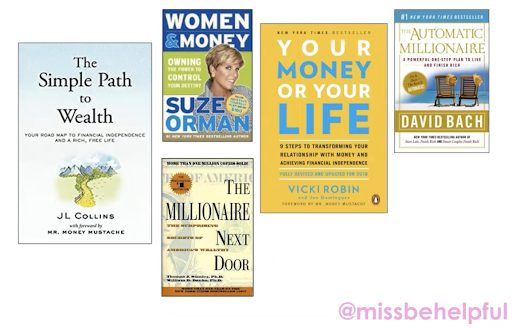

The first book Espinal read as part of her financial education was Suze Orman’s Women & Money. She says this book is an “easy entry point to learn about money,” and encourages people to explore Orman’s podcast, YouTube show, blog and other digital resources that are free.

The Millionaire Next Door is another choice on Espinal’s list because the authors interview first-generation millionaires about their financial habits, mindsets and their path toward financial security.

“The information in there was so shocking to me because I thought the millionaires would be like Kim Kardashian and live a certain lifestyle,” she said. “Most millionaires are average, everyday people who drive regular cars and wear regular clothes because they don’t show off their wealth and waste their money on status symbols.”

Another resource is a 2012 TedTalk called “One Life-Changing Class You Never Took” by Alexa

Von Tobel, the founder and CEO of LearnVest.com.

Of course, Espinal offers many of her own resources for free, whether they are through her YouTube channel, speaking engagements, website, social media and more.

If you’re considering following your dream of teaching, Rutgers Alternate Route can offer you the support and training you need to succeed. Be sure to follow Rutgers Alternate Route on Twitter and sign up for Alternate Route’s monthly newsletter for more information and stories from the field of education.

Heather Ngoma has over 25 years of experience collaborating with educators across New Jersey to drive education innovation. She currently serves as the Director of the Rutgers-GSE Alternate Route Program in the Department of Learning and Teaching, a program which helps career changers, recent college graduates, and other aspiring education professionals become licensed teachers in New Jersey. Follow her on Twitter @heatherngoma.

Heather Ngoma has over 25 years of experience collaborating with educators across New Jersey to drive education innovation. She currently serves as the Director of the Rutgers-GSE Alternate Route Program in the Department of Learning and Teaching, a program which helps career changers, recent college graduates, and other aspiring education professionals become licensed teachers in New Jersey. Follow her on Twitter @heatherngoma.